It appears that there is a good evolutionary reason for taking big risks. Those of our hunter-gatherer ancestors who took bigger risks in chasing bigger prey would profit far more than those who played it safe. The risk-takers would fail much more, but even occasional successes meant they would end up stronger, smarter, healthier, and with bigger families, allowing them to figure out better strategies for catching larger prey. That concept translates well to the question of how do you calculate risk management in crypto?

Risk is not meant to be undertaken indefinitely and for the sake of excitement; that is called gambling and should be avoided at all costs. Risk management in crypto should be calculated by various factors such as setting a trading strategy in advance, setting a target return and stop-loss orders before entering the trade, doing your due diligence to avoid being scammed, and not buying into the hype.

The human brain is awful at calculating risks or chances in general. For example, if there is a 50-50 chance that a flipped coin lands heads or tails, and it has already landed heads five times in a row, what is the chance there will be a 6th consecutive heads? The answer is: 50%. The chance always remains the same because the coin doesn’t remember but people do. Still, there is an exception detailed below where the chance is arbitrarily low or high.

People remember past outcomes and assign all kinds of narratives and reasons as to why the coin landed or should have landed heads instead to tails, becoming emotionally invested in the narrative and the outcome. When the outcome doesn’t materialize the way they expected it to, they become tilted. Granted, in a sufficiently long run the coin will average out to 50% heads and 50% tails, but that will take millions of coin flips that will include completely unpredictable streaks of 6, 66, and 166 heads or tails in a row.

Randomly investing in cryptocurrencies and hoping to strike it big is similar to investing in a coin landing 6 heads in a row. It can happen, but that strategy is not viable in the long run, more often than not leading to bankruptcy. You need to understand risk and create a risk management strategy to avoid bankruptcy and emotional meltdown. It helps if you understand the appeal of risky investments and the way your brain processes emotions related to risks.

How do you calculate risk management in crypto? Setting the target return

To explain it using the hunter-gatherer analogy, setting the target return means you would either decide to hunt rabbits or geese, but you would not chase both at once or start chasing one and then switch to another. In addition, you would not try to hunt all rabbits and all geese in the area but just enough to give you a taste of victory and sustain you while you figure out a better hunting strategy. Being greedy is a foolish strategy that leads to hunger, frustration, and exhaustion. The gist is that you need realistic, sensible goals and the composure to call it quits when you reach or fail to reach them within a certain time period. So, how do you calculate risk management in crypto?

Suppose your investment budget is $1,000 and you set yourself the goal of doubling that with one investment. In that case, you’ve locked yourself into looking for an asset that will yield a 100% return, which will invariably lead you to exceptionally risky assets. To make matters worse, by that time you will have the “bet the farm” mentality that will make you ignore risk. A much more sensible strategy is to give yourself a fixed goal, such as getting a $1 profit.

That sounds puny until you realize this strategy gives you much more flexibility in looking for profitable assets and sets a low threshold for success. If you can repeatedly gain $1 in profit on your investment, you’ll learn much about crypto assets and the associated dangers. That will give you the confidence boost to apply your strategy to larger investments. Setting a low threshold for success also means you won’t have an emotional meltdown if you lose the investment.

Common risk management mistakes in crypto trading

Investing in 6 heads in a row means that you’ve exposed yourself to an extraordinary amount of risk because there is little chance of gain (1/64 or about 1.6%). Besides, you don’t know anything about the game. Can you inspect the coin before the game starts? Is the coin flip done by a machine or a human? Can you watch the coin flip occur in real time or attend the coin-flipping session? The same logic applies to cryptocurrencies — if you don’t know anything about them and can’t access the behind-the-scenes info, they might be controlled by insiders who can manipulate their price and are no safer than the coin flip game.

The chance of a coin landing heads or tails is or should always be at 50%, except when the game is rigged. Perhaps the coin is faulty or is designed to land heads or tails when flipped a certain way, or the footage of coin flipping is prerecorded. Every game will attract cheaters who may cheat just for the sake of causing grief. Add a tantalizing financial incentive, and you’re sure to encounter cheaters of all kinds, who will do their utmost to gain an edge over those who play fairly, even if that edge is only 1%. Thus, the most common risk management mistakes in crypto trading have to do with failing to detect faulty or manipulated crypto assets.

No due diligence

The most common crypto trading mistake is investing in a cryptocurrency without vetting its technology and the people behind it. Countless investors have the “I’m going to invest $100 in this crypto, and if it goes to the Moon I’ll be rich” mindset, which is equivalent to gambling. That doesn’t work because a cryptocurrency may have a high market cap but low liquidity. Even if you do buy some amount of a crypto and it skyrockets, there might be no money in the system or there is nobody to sell it to at that higher price.

As of April 2024, there are over 23,000 cryptocurrencies, with a combined market capitalization of $2.31 trillion. Considering that Bitcoin launched in 2009, that means on average four new cryptocurrencies have been launched every day for the past 15 years. The chance of any of them repeating Bitcoin’s success is miniscule, roughly 1/23,000 or 0.0043%.

The vast majority of cryptocurrencies are not designed to be used in the real world for actual purchases. Their only purpose is to draw in risk-taking investors who want to catch the next Bitcoin and don’t care about losing $100 or $1,000. Therefore, there is no widespread interest in them, save from crypto influencers who promote them.

Buying into the hype

Most cryptocurrencies are unknown to the general public because marketing is expensive. But, some people have the spotlight trained on them and can use the media attention to generate marketing and hype for whichever crypto they want. The most famous of them is Elon Musk.

In a series of tweets and media appearances, Elon Musk praised and memed Dogecoin, which for years traded at $0.0002, proposing to use it for Tesla purchases. In April 2019, Elon tweeted “Dogecoin might be my fav cryptocurrency. It’s pretty cool.” In February 2021, Elon Musk posted “Dogecoin is the people’s crypto.” By May 8, 2021, Dogecoin surged to $0.68, a 3,400-fold increase. In the following year, Dogecoin plummeted to $0.08 and then slowly crawled back to $0.14, which is where it’s at in April 2024.

So, what caused the Dogecoin price drop? On May 9, 2021, Elon Musk appeared on Saturday Night Live, a comedy show, and called Dogecoin “a hustle.” Within a week, Dogecoin’s five-month price surge was over and it lost over a third of its value. It’s hard to claim Elon’s SNL appearance was the sole reason for the Dogecoin price drop but that likely had some influence on it.

Elon still maintains that he will allow people to use Dogecoin to buy a Tesla and that people can already buy Tesla merchandise with it. However, when Elon did the same for Bitcoin, he quickly dropped the idea, citing environmental concerns. In the meantime, Elon was named as the defendant in a $258bn Dogecoin lawsuit that claims he manipulated Dogecoin’s price to profit off the Dogecoin he owned.

The problem with media personalities and crypto influencers who build hype is that they don’t reveal their stake in the game. Is someone paying them to promote that crypto? Do they hold some of that crypto and want to pump its price up? Did they short that crypto and want to crash its price? Buying into their hype without knowing their agenda means your emotional state and your investment is at their mercy. As one analyst said for Reuters about the Dogecoin price drop, “Anyone who wants to play the Elon Musk game should be prepared to lose all their money.”

Best strategies to manage risk while trading crypto

So, again, how do you calculate risk management in crypto? The best crypto risk strategy is the one that doesn’t bankrupt you if you lose all your investments. That means you have a separate budget for crypto investments and your main budget covers all your fundamental needs. If you’re mulling over between paying rent and investing in crypto, you should pay your rent and only think about investing in crypto when you have enough money to create a separate budget for crypto and can afford to lose 100% of that.

Avoid borrowing money from friends and family to invest in crypto at all costs. There is the possibility you will lose it all, but even worse is if you get rich from their loan. They will constantly pester you for gifts and tokens of appreciation, to which they will feel entitled to, which will sour your relationship.

Vetting

Vetting means that you check platforms, influencers, cryptocurrencies, and underlying technologies regarding their:

- track record

- certifications and licenses

- associations with known bad players

- propensity to cheating, lying, and scheming

Those who fail all four tests are the most prone to catastrophic losses and should be avoided at all costs, no matter the hype surrounding them. That does not imply malice but rather a lack of control over their actions. It’s still possible to make 100x on your investment in those cases, but you’re playing with fire.

A great role model regarding crypto vetting is Stephen Findeisen aka. Coffeezilla on YouTube. He performs exhaustive crypto research, the principles behind which are applicable to financial investments in general. You should copy his methods and vet people, platforms, and cryptos before investing a cent in them.

Stop-loss orders

Stop-loss orders are a way to prevent catastrophic losses by calculating the average price of a given crypto over a certain period and automatically selling it when the price drops near the average. However, the average is a vague metric for any set of numbers related to an asset that suffers from extreme volatility. Averages squish the highs and the lows into a middle number that doesn’t reveal why either happened and may give a false sense of stability.

Stop-loss orders should be combined with other crypto trading analysis tools and only used on cryptos that have not shown volatility or signs of manipulation. If the crypto is manipulated, the manipulator can sharply drop its price to execute investors’ stop-loss orders, leading to a cascade of stop-loss orders being executed. One of these signs of manipulation is called “reverse Bart haircut pattern” and indicates the exchange is colluding with insider investors to trigger stop-loss orders and liquidate gullible crypto scalpers.

Avoid overtrading

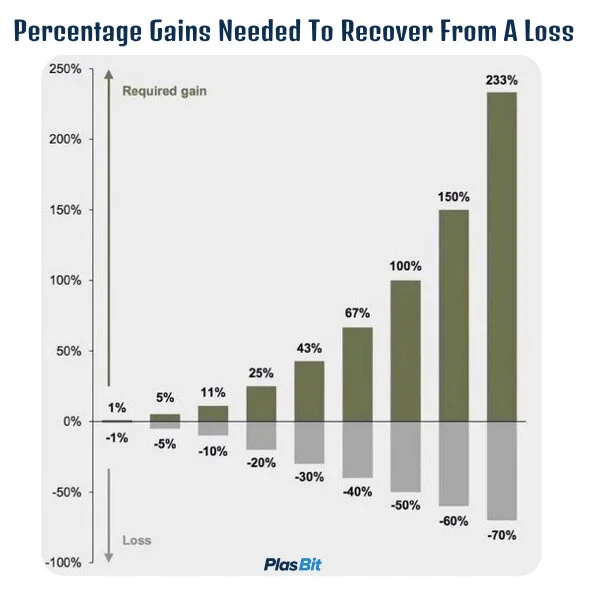

Overtrading happens when the investor experiences losses and frustration to the point of tilting and betting the farm on the next few consecutive trades. That is a sure way to lose your investment. The problem is that the gains always have to be percentually higher than the losses just to break even.

An investor who starts with $100 and loses 10% of it on a trade is left with $90. To break even, the same investor needs to invest that $90 into an asset with an 11% return. Losing 50% from the initial $100 means the investor has to invest the remainder into a trade with a 100% return and so on. The best way to calculate risk management in crypto is to estimate the percentual gains needed to break even in case the investment is lost.

Quick consecutive trades, whether positive or negative, lead to heightened emotions, which further cloud the investor’s judgment. Learn to recognize when you’re going into the “bet the farm” mentality and call it quits for the day or the week.

Main risks in crypto trading

The risk in crypto trading is not always equivalent to potential gains. Even when a crypto seems promising, there can be hidden pitfalls created or masked through incompetence, disinterest, or malice. How do you calculate risk management in cryptowhen it comes to scams and frauds?

Scams & frauds

In January 2018, a cryptocurrency called Mobius appeared on the market, trading for $0.45. In a February 2018 interview, the CEO of Mobius, David Gobaud, described Mobius as a “turn-key blockchain-enabling platform” that will power the smart contract ecosystem, obviously hinting at replacing Ethereum. He described how Mobius works by saying, “Oracles compete on quality and are segmented into tiered levels in order to overcome the market for lemons problem and provide a transcendental quality differential.”

By May 2018, Mobius was trading at $0.07 and by November its price was at $0.01, representing a 97% drop from the launch. The Mobius website is still up but the links to the Google and Apple App stores are not functional. There is a grand total of 888 million MOBI but 0 of it in circulation, making its market cap $0. The devs and the MOBI company hold over half of all MOBI.

Was it a scam? A fraud? It’s impossible to tell but the project has been all but abandoned after a hacking incident, which points to poor fundamentals and a lack of long-term vision.

Lack of security

To continue with the Mobius example, the last dev update is from June 2022, where David explains that there was an incident. Apparently, the devs had to freeze 129 million MOBI because of a hack. A hacker allegedly intercepted Mobius users’ emails as they were making their wallets on the official website and redirected their MOBI tokens to different wallets. David and his team quickly froze those tokens and apparently put the entire project on ice.

David does not explain why or how the hack happened, except to state “somehow these emails were intercepted.” That points to poor network security and poor implementation of security protocols. The troubling part isn’t the incident but the lack of accountability from the devs. If they made a mistake in implementing the wallet, they should be honest and admit it. Instead, David says that “email today remains extremely insecure”.

Lack of regulation

There is little legal recourse in case something like the Mobius hacking incident happens to you. The devs can be incompetent, indifferent, or malicious, leaving bugs and exploits in the crypto code. Crypto exchanges can collude with insiders to manipulate the crypto price, wipe out investors, or embezzle funds. Media personalities can manipulate crypto prices as well by driving fear or enthusiasm to wipe out scalpers through Barts and reverse Barts.

The best example of how little legal remedy you have in the crypto space is Mt. Gox. The Mt. Gox crypto exchange was shut down in February 2014 due to a hacking incident that stole investor funds; as of late 2023, the remaining 142,000 Bitcoins still haven’t been distributed to creditors.

PlasBit

You will never reach financial freedom if you don’t find an answer to “How do you calculate risk management in crypto?” Flipping coins or going on a random goose chase in the dark won’t cut it. Financial freedom is available only to those who learn about it and work toward it with a strategy in mind. The amount of money you invest is not important; what matters is your dedication to learning about cryptocurrency trading. You must create a crypto investment strategy that suits you based on the information you have.

PlasBit is dedicated to bringing crypto investors the most valuable asset of today — information. We trawl the internet and the crypto price points to give you genuine insights into how crypto works and how crypto markets move and then we let you decide. Our principles in sharing that information with you is:

- PlasBit aims to build a community of like-minded people who will benefit from our ecosystem, and thrive together with us

- We are here to help our community achieve full financial self-sovereignty

- We are delighted to provide our users with the options to reach and maintain true autonomy

- Everyone is responsible for their financial choices and financial security

- Our end goal is for everyone to live in an open society and reach financial liberty

Conclusion

Cryptocurrencies came from an obscure nerd joke to a mainstream media joke in mere 15 years. Banks are increasingly adopting them and governments are legislating their trading, such as by including them in tax forms. Whether we like it or not, we will all have to learn to deal with cryptos and their quirks. That doesn’t mean we have to go on a wild goose chase or bet on coin flips to find the next Bitcoin. There is logic behind how crypto prices rise and fall; it is up to you to discover and exploit that logic.

In this article, we’ve described the fundamental crypto risk factors in an approachable way and explained how you can manage your risk and your perception of risk. Becoming emotionally stable to the point of objectively assessing crypto outside of hype is by far your most valuable asset. Do not chase coin flips, do not buy into the hype, and do not chase random trails. Every crypto investment you make then becomes calculated and part of your crypto investment strategy, leading you to stable portfolio growth and steady returns.

EN

EN